You don’t need an MBA in accounting to take control of your company’s finances. You just need to understand that there are certain leading indicators that affect the outcome of certain lagging indicators—and when the two are in alignment, success will likely follow.

“We as owners have always been taught to look at the financials, the financials, the financials,” says Dennis Barriball, owner and general manager of Hemlock Landscapes in Chagrin Falls, OH. “The problem is that by the time you look at these numbers, it’s too late to do anything about them. What we really need to look for are ways we can improve the processes that drive financial performance.”

Leading vs. Lagging

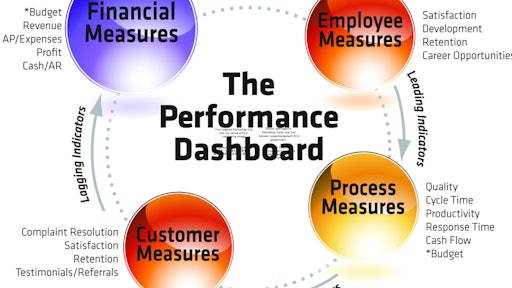

Barriball has developed a “dashboard” that separates the lagging indicators from the leading indicators. “As a leader in your organization, you must balance the view between lagging and leading,” Barriball says.

The lagging indicators include financial measures such as budget, revenue, accounts payable, expenses, profit, accounts receivable and cash. This data, for the most part, tells you the result of past performance. While very important to monitor on a monthly basis, this data will not tell you what you need to do in order to correct a problem. This data simply tells you that there is (or isn’t) a problem.

At the other end of the spectrum are the most leading of the leading indicators: employee measures. Things like employee satisfaction, development and retention provide a different kind of company snapshot: your ability to build a strong team.

Somewhere in the middle are two more sets of leading indicators: 1) process measures such as job quality, cycle time, productivity and response time, and 2) customer measures such as complaint resolution, satisfaction, retention, testimonials and referrals. These two sets of measures provide yet another type of snapshot: your company’s ability to operate efficiently while providing high-level service.

Leading Indicators Drive Performance

It’s important to continually monitor the leading indicators. When you and your team remain focused on them, the results are much more likely to be favorable. And when those results are favorable, the lagging financial indicators typically shine as well.

Customer Measures. “If we’re retaining customers and compiling a lot of good testimonials, that’s a pretty strong indicator that we’re going to have some financial success down the road in terms of revenue, profit and cash flow,” Barriball cites as an example.

Hemlock Landscapes conducts customer surveys. As an example, one such survey asked a single question: On a scale of 1 to 10, how likely are you to refer us to a friend? “We ask the 9’s and 10’s for testimonials and referrals,” Barriball tells. “For the 7’s and 8’s, we make it a priority to reach out to them to try and improve their perception of us.”

Senske Lawn & Tree Care based in Kennewick, WA, is also diligent in using customer surveys. President Chris Senske says each customer is given the opportunity to complete a survey after each service and service call. “We offer a scale of 1 to 10, plus written comments,” Senske points out. “We share this information with all of our employees every week.” Senske prefers to ask three questions in his customer surveys: overall satisfaction, likelihood of recommending to a friend or relative, and likelihood of continuing service.

Speaking of continuing service, customer retention is another important leading indicator that’s religiously monitored and shared with Senske employees. “We look at the ratio of current customers who were with us last year divided by the total number of last year’s customers,” Senske explains. “Our goal is 85% in pest control, 80% in lawn care, and 95% in grounds maintenance.”

Process Measures. Improving the results of your customer measures often requires you to back up one more step to address your process measures. After all, resolving complaints and/or retaining customers must be preceded by quality, productivity and quick response time.

Barriball says he and his management team create scoreboards throughout the company. Each department has at least one—and each is tied to a greater company-wide goal such as revenue or profit.

“We score things like safety, equipment uptime, crew efficiency and gross margin,” Barriball says. Cycle time is another important area. “We’re always looking at routing times, and the time it takes to convert a sales lead into a proposal into a sale.”

A key philosophy of the Working Smarter Training Challenge is to be “hard on processes, soft on people.” Barriball illustrates, “If one crew is consistently below their target, why is that? Do they need more training? Does a certain process need to be improved so the crew can become more efficient? On the other hand, if one crew is consistently above average, what can we learn from them? Can the other crews implement some of the things this over-achieving crew is doing?”

Employee Measures. This leads to the final and most-leading of leading indicators, employee measures. Are your employees happy to be working at your company? Do you have a good training and development program in place? Does your company provide the opportunity for career advancement? These are questions you must continually ask.

A Fresh Look at Your Financials

All of this attention on leading indicators does not mean that key lagging (financial) indicators should be ignored. In fact, Barriball says that if you are only looking at your P&L when your accountant prepares it during tax season, you’re doing yourself and your company a disservice. Barriball’s best advice is to look at the key financial information monthly (sales, profit margin, expenses, cash and receivables). Then, look for trends.

Finally, Barriball says it’s important to compare what you’d actually spent to what you’d originally budgeted. Likewise, it’s important to look at what you actually sold vs. what you thought you’d sell. Monthly financial indicators are going to tell you how your company is performing. But then it’s up to you and your managers to maintain your focus on those leading indicators that lead to even better performance.