Results from Green Industry Pros' annual fall survey of landscape contractors suggest that 2015 was a good year for the landscaping services industry, and there's reason to be equally optimistic about next year.

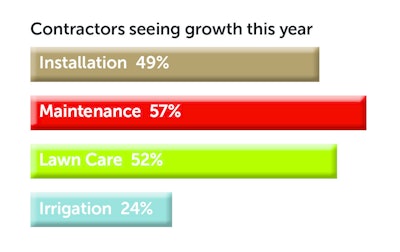

A little over half of contractors say sales have been up across the board this year—in both installation, maintenance, lawn care and irrigation. Few (6-7% for maintenance and lawn care, and 13% for both installation and irrigation) say sales have decreased.

Landscapers are even more bullish about 2016. Roughly two-thirds expect to grow sales in their installation, maintenance and lawn care divisions next year. Nearly half expect to grow irrigation sales. Very few (3% or less) expect to see a sales decrease in any of their four major service areas.

There has also been widespread growth in a variety of specialty services. Of those contractors who perform the following services, a significant percentage say business has been growing:

- Hardscaping – 54%

- Lighting – 39%

- Tree Care – 46%

- Lawn Renovation – 47%

- Pest Control – 51%

- Organic/Natural Lawn Care – 47%

- Snow Removal – 62%

Several key economic drivers have been playing in the landscaping industry's favor. According to IBISWorld, a worldwide research firm with offices in New York and Los Angeles, significant improvements in housing starts and commercial construction have helped propel the industry for the past several years—and will continue to through 2020. Also helping the industry to grow for the next five years will be a steady increase in per capita disposable income, and an aging population that's in need of a variety of home services, including lawn care and landscaping.

Pricing, people and profits

Contractors continue to make progress on the pricing front. A little over half feel comfortable about raising prices on at least half of their clients next year. Taking it one step further, many contractors plan to raise prices on the majority of their accounts: 37% in residential maintenance, 46% in residential installation, 39% in commercial maintenance and 42% in commercial installation. A small number of contractors (7-15%) plan to keep prices the same for all clients next year.

This steadily improving business climate is helping to create a steadily increasing need for employees, particularly laborers. According to the survey results:

- 43% added installation laborers this year, 11% cut back ... 49% plan to add more next year, 1% plan to cut back

- 52% added maintenance laborers this year, 9% cut back ... 63% plan to add more next year, 1% plan to cut back

- 27% added installation foremen this year, 5% cut back ... 37% plan to add more next year, 3% plan to cut back

- 26% added maintenance foremen this year, 7% cut back ... 45% plan to add more next year, none plan to cut back

Many contractors also have a growing need for non-field personnel. Roughly 20% added managers, sales and administrative personnel this year. Roughly 20-25% plan to do so next year. Few (1-3%) plan to cut back on this type of staff next year.

Increased business and pricing typically lead to an increase in profitability, provided that those increases outpace any rise in the cost of doing business. But landscape contractors seem to be staying ahead of the game. According to the survey results, nearly two-thirds say they are more profitable than they were five years ago. Just 12% say they are less profitable.

If you're happy and you know it

As you can see, there are quite a few indications that the landscaping services industry is sound and that it's a good time to be a landscape contractor. That said, this business is not without its challenges. An increasingly costly and unreliable labor pool, rising materials and overhead costs, erratic weather patterns, cutthroat competition, and the perpetual threat of additional regulatory burdens all help to keep contractors on their toes.

According to the Green Industry Pros survey results:

- 31% of contractors say they love this business and wouldn't do anything else

- 53% say they are pretty happy

- 14% say being a contractor is simply a way to pay the bills

- 2% say they are miserable

As the landscaping industry continues to evolve, consolidate and grow at a controlled pace over the next several years, it will be interesting to see where that bottom 16% ends up. This industry remains one that is fairly easy to break into, but not so easy to persevere in. Without a dual passion for both landscaping and business, perseverance is only becoming more difficult.

Here's one bright spot to think about if you're an established, passionate landscape contractor. According to IBISWorld, the number of landscaping companies is expected to grow just 2% or so per year for the next five years. Compare this to 2007 when the growth rate was around 16%, or even 2010 when it was around 4.5%.

In other words, the competition you face today, generally speaking, is the competition you'll face for the next several years—give or take those who succumb to the pressures of this business and bow out. Hopefully your company doesn't end up being one of those that do.

![Doosan Bobcat Wacker Neuson Stack 2ec Js Pb V6e[1]](https://img.greenindustrypros.com/mindful/acbm/workspaces/default/uploads/2025/12/doosan-bobcat-wacker-neuson-stack2ecjspbv6e1.CPyyz8ubHn.png?auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=100&q=70&w=100)

![Doosan Bobcat Wacker Neuson Stack 2ec Js Pb V6e[1]](https://img.greenindustrypros.com/mindful/acbm/workspaces/default/uploads/2025/12/doosan-bobcat-wacker-neuson-stack2ecjspbv6e1.CPyyz8ubHn.png?ar=16%3A9&auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=135&q=70&w=240)