Creating a long-term vision for your company that includes a vision for your best employees is the secret for success in the lawn care industry.

That’s the advice of Jen Lemcke, chief operating officer for Weed Man, a franchise lawn care business started by her father, Roger Mongeon. The company, founded in 1970, has grown to become the largest franchised lawn care company in North America, with more than $175 million in revenue in the United States.

Lemcke started in the business in 1993 and has worked in every position in the franchise, from field technician to marketer and now COO. She recently participated in a webinar to speak about building a business plan and creating a long-term vision for employees.

Help When Starting a Lawn Care Business

For those just starting out in the lawn care business, especially those on a tight budget, Lemcke suggests reaching out to state and national associations for help. Those groups offer training and tips, and will connect entrepreneurs to business resources.

“The beauty of our industry now is that we have such great people who have so much knowledge,” Lemcke says. “People are so ready to help people get on their feet. And don’t leave any rock unturned; look for peer groups and mentors in the industry.”

When searching for mentors and consultants, make sure to choose someone who has experience in the lawn care industry, she says.

“If you’re looking in the lawn care realm, I would look for someone with lawn care experience to help you do that,” Lemcke says “I wouldn’t necessarily go to a consultant who has done a landscaping company, because we are a different business.”

Updating Your Business Plan

When creating a plan and budget for the upcoming year, owners and managers should plan to sit down together for two to five days, depending on the company’s complexity. Those involved in the business planning and budgeting process should pick a place, whether onsite or offsite, where they won’t be distracted.

“In my opinion, cell phones should be turned off and you should be completely dedicated to the process,” she says. “Many owners prefer to do it offsite; they feel that they’re more focused and their people are more focused. It allows them to really delve into things that they’ve seen.”

Start with a review of the year and ask for feedback from managers about struggles and obstacles.

“It’s nice when everyone is sitting at the table who’s going to be involved in making it happen,” Lemcke says. “Bringing down those walls, I don’t know your experience, but when I was in operations, it was a daily battle or work in progress to make sure my admin wasn’t upset with my technical and my technical wasn’t mad at my marketing, and everyone was free flowing and incredibly pulling together on the same wavelength. If they’re not, that’s when things start to break and fall apart. So, creating that team and not silos, in your company is something that’s so important.”

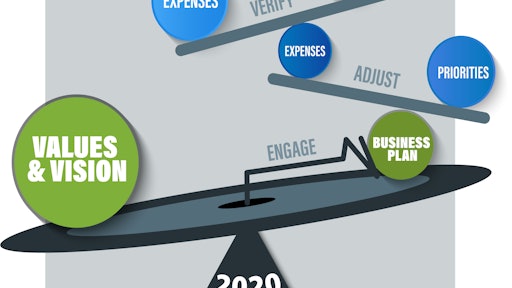

Once priorities, expenses and an overall plan is in place, it’s important to act on it.

“The business plan, it’s important that you don’t create it and then forget about it,” she says. “It’s important that you engage it when you’re making decisions (throughout the year), that you’re pulling it out and then you’re saying, ‘Ok, what did we say we were going to do?’ and ‘How are we doing?’ along the way.”

If the plan was to order fertilizer by a certain date, did that happen? One of the best ways to stay on target is to incorporate the plan into the company’s accounting software, she says. Those who use QuickBooks will need the desktop version, not the online version of the software, to do this.

“You can put your business plan into your software and then you’re able to track, what are your monthly expenses versus what I said I would spend and be able to adjust on the fly,” Lemcke says. “If you’re not making it, if you’re top line isn’t in a position where you thought you’d be, then you absolutely need to be in a position where you adjust those costs.”

At Weed Man, they review the plan six months in.

“We do a June hard look and that June we assess our marketing plan, ‘Did we achieve it?’ If not, then we realign our expenses, so we essentially do a mini-budget halfway through to align it with our top and bottom lines,” she says.

Once those pieces are in place, it’s important to share the numbers with others on the team.

“We share these numbers with our management team so they can see exactly where they are and where they’re not,” Lemcke says.

They refer to the process as the 'management circle', where the company’s vision and values determine the business plan. Throughout the year, decisions are checked to ensure they match up with the plan.

“The big thing is we verify,” she says. “Are we doing what we said we were going to do and verifying and following up with our employees? Do they understand if they’re hitting the mark, or if they’re not hitting the mark?”

Zero-Based Budgeting

At Weed Man, managers use a process known as zero-based budgeting when creating profit-and-loss statements and budgets. With zero-based budgeting, all expenses must be evaluated and approved at the start of each new budget cycle.

“We start from scratch each year and make sure each expense is viable,” Lemcke says.

Each franchise tracks and plans for expenses ranging from the cost of gas and equipment to office supplies and marketing on an annual basis to ensure spending is on track.

“It gives you the opportunity to cut costs on things you wouldn’t have thought about in the past,” she says.

With the budgeting year planned out, franchisees then decide on when they will pay expenses.

“We then take that, all of those expenses, and we identify when they’re going to be coming out of the bank,” Lemcke says. “If I’m ordering fertilizer for March, that bill may not be due until July. So, you may not want to put your expense in until June. We create a P&L (profit-and-loss statement) that is as accurate to reality as possible.”

Scheduling Payments

Through tracking previous payments and a strong knowledge of vendor terms, Weed Man franchises are able to make an accurate prediction of when bills will be due, and orders need to be made. They compare that to times during the year when profits are strong.

“We’re able to really assess our cash flow, top line and bottom line, each and every month and it gives us some really great tools, for going to see the bank, for example,” she says.

The key is to plan around when income will be flush.

“Banks don’t like to lend you money when you need the money, they like to lend you money when you don’t need the money,” Lemcke says. “If you have an idea that in March and April, you might be doing marketing, you might be a northern market and that’s when your lowest cash flow is. That’s when you would want to go see the bank in January, when you have all of your prepaids that have come in and you have money in the bank. These tools really help you make sound business decisions and even help you create that relationship with the bankers to allow you to increase your credit line based on your needs for the season.”

Vendors can also be flexible in billing, she says, as many understand the seasonal fluctuations in cash flow.

Creating a Future Plan for Top Employees

Weed Man encourages its franchisees to create a 10-year business projection, to think about possible acquisitions and new territories that may not seem possible at the moment. Franchisees walk through how those possibilities might affect their top and bottom lines. An important part of that planning is creating a future for the company’s best employees.

“That’s the secret sauce to all of this working, is the people,” Lemcke says. “If you have ‘A’ players in your organization but you’re not creating a vision for your company to allow them to see where they can grow, you’re probably going to lose some of those ‘A’ players in your company.”

Not creating a vision is a problem Lemcke has witnessed too often.

“We’ve seen it time and time again, where people get comfortable in their business,” she says. “They have this superstar employee and the owner starts to step back from the front lines. They’re feeling really good, because they have this great employee and they kind of maintain status quo. That employee leaves and they’re kind of absolutely dumbfounded, ‘Why is this happening?’”

The status quo, though, can be a turnoff for high performers.

“If we’re not creating opportunities for our key people, it becomes very apparent to them that, ‘This is going to be my life,’ for the rest of their life,” she says.

While creating five- and 10-year plans for the company, it’s important to create organizational charts for employees along each step of the way.

“It allows you to say, here you are now, and this is where I see you going,” she says. “Or, our long-range plan is, we’re going to do an acquisition in two years, and we see you as being that person who is going to run that organization for us.”

The manager can set up a training schedule for the key employee to follow, to help the employee meet the expectations of the future position.

“We create training plans that go alongside this manager’s growth and how they’re going to get to be able to run their own business, or in a lot of cases, because we truly promote the owner/operator model, is that this young person has come through our organization and will become a shareholder in our next opportunity or the next acquisition that you do.”

Business owners and managers should always keep an eye out for employees with the potential to do more in the company, she says.

“What makes being in business for yourself so rewarding is to see some of these young people coming up through your organization and growing,” Lemcke says.

Making these types of strategic decisions for a business will lead to a better use of capital, more efficient operations, the ability to identify opportunities and measure progress, she says.