Only 9% of construction firms are planning to lay people off this year, compared with 37% last year and 55% in 2010. Furthermore, 32% of firms report that they plan to add new staff in 2012. Even more positive, half of those firms report plans to add six or more new employees during the next 12 months.

This data is based on survey results released by the Associated General Contractors of America and Computer Guidance Corporation. The survey, conducted as part of the 2012 Construction Industry Hiring and Business Outlook, shows that many firms expect key private sector market segments to expand this year even as the overall outlook remains mixed.

“While there are some promising signs, especially when it comes to construction employment, the outlook for the industry is mixed,” said Stephen E. Sandherr, the association's chief executive officer. “More than four years after demand for commercial construction began to plummet, economic conditions remain difficult.”

Things will improve this year, but a more meaningful recover is expected to take place in 2013.

State-by-state look. Among the 29 states with large enough survey sample sizes, 57% of firms in Wisconsin plan to hire new staff this year, more than in any other state. Only 16% of firms in Virginia plan to add staff this year, the least amount in any state. Meanwhile, 18% of firms in Missouri plan layoffs for this year, the highest percentage of any state. No firms working in South Carolina reported plans to make layoffs this year. (Click here for state-by-state survey results.)

Key building segments. A majority of firms expect the dollar volume of projects they compete for to either grow or remain stable in every market segment. In particular, roughly three-fourths of contractors expect the power and the hospital and higher education markets to expand or remain stable this year. In contrast, contractors working on a number of market segments typically funded by the public sector are more pessimistic. Roughly 44% of contractors expect the market for new public buildings to shrink, 41% expect the market for K-12 school construction to shrink and 40% expect the highway market to contract.

Credit crunch continues, “green” stalls. In addition, many contractors report they continue to be impacted by tight credit conditions. Nearly half report that tighter lending conditions have forced their customers to delay or cancel construction projects. Perhaps related to the tough credit environment, 60% of firms expect demand for green construction projects to either stagnate or decline in 2012.

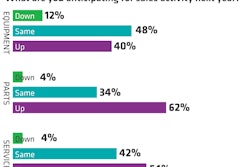

Cautious with equipment. Simonson added that contractors appear cautious with their plans for acquiring new construction equipment. Many more firms report plans to lease, instead of purchase, new equipment. Only 40% of firms report they plan to buy new equipment this year, while 66% plan to lease. Even as they shift toward more leasing, firms’ appetite for new equipment remains modest, with 57% saying they will buy $250,000 or less in equipment and 70% saying they will lease $250,000 or less worth of equipment this year.