The dramatic collapse of the Francis Scott Key Bridge in Baltimore, Maryland, has raised significant questions about the robustness of supply chains operating in and out of the Port of Baltimore. The port is a major roll-on/roll-off (ro-ro) port for construction and agricultural machinery, and the incident, which caused loss of life, is likely to have an impact on imports and exports for the off-highway vehicles industry. However, the question is what alternatives exist and how significant will the impact be?

Following the collision of a container ship with one of the support columns, the collapse of the 1.6-mile long Baltimore Bridge into the Patapsco River has featured in headlines around the world. In addition to the tragic loss of life, news reports have covered the potential impact on global supply chains, with all traffic through the port currently suspended until further notice. The Port of Baltimore handled more than 47 million tonnes of foreign cargo last year and U.S. Secretary of Transportation Pete Buttigieg has stated, “There is no question that this will be a major and protracted impact to supply chains."

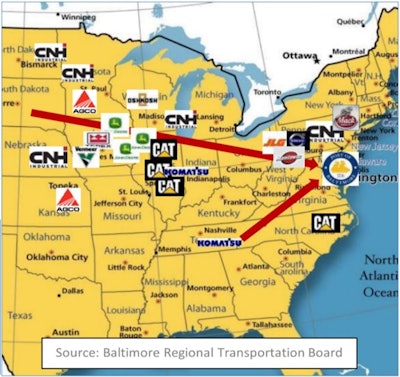

In general, Baltimore is the No. 1 U.S. port for ro-ro cargo. A U.S. census reveals the Port of Baltimore was No. 1 in the country for farm machinery imports and exports ($5 billion) in 2023 and third for construction machinery ($6.6 billion). Imports of construction machinery exceeded exports by a factor of more than five, with the port serving as a key port for imports of vehicles from Europe and China. The figure below details some of the major manufacturers of construction and agricultural machinery that use the Port of Baltimore for exports.

A container ship, the Dali, struck the 47-year-old bridge after losing power. The Dali made a distress call and dropped anchor to slow the vessel, causing authorities to shut the bridge to traffic and likely savings lives. The victims of the disaster were six construction workers fixing potholes on the bridge when the collision occurred in the early hours of March 26, 2024.

In the wake of the collapse, two temporary channels around the wreckage have been established in and out of the port to provide access for some shallow-draft vessels and a third channel is planned over the coming days. However, this does not mean the Port of Baltimore is back up and running, a process that could take considerably longer. There are also a number of large commercial ships, including the Dali, unable to leave the port because of debris remaining in the channel and the process of removing it is a difficult and hazardous one for the authorities.

Maryland Gov. Wes Moore has stated it is likely to take more than a month before the port reopens. Replacing the bridge itself, which was named after the man who wrote the poem behind "The Star-Spangled Banner," could take years.

Interact Analysis has identified the following short-term effects of the Francis Scott Key Bridge on the off-highway vehicle supply chain:

- Longer delivery times for imports: For construction machinery orders from outside the U.S., different ports will need to be used if Baltimore is the main entry point. This could cause delays, with additional warehouse space for temporary storage required and changes made to on-road transportation routes.

- Delays or increased costs for specific equipment types and models: In some cases, there may be no easy alternative to the Port of Baltimore, and end users could face delays or increased costs as a result. However, the effect may be minimal, depending on the equipment type, with ample supply between domestic construction machinery production in the U.S. and dealer inventory. In these instances, it is unlikely contractors or dealers will face equipment shortages.

- Price increases: Short-term price increases are anticipated for certain models because of the points raised above, with additional costs incurred by changes to the logistics network potentially passed onto customers.

However, any impact on the off-highway vehicles supply chain in the U.S. is expected to be short term, and we expect that things will return to normal relatively soon. According to estimates for the bridge repairs, the port should reopen towards the end of May (although setbacks could well push this to the end of June). In the meantime, the Port of Savannah in Georgia (No. 1 in 2023 for imports and exports of construction equipment) and other ports along the East Coast—many of which are considerably larger than Baltimore—should be capable of handling any additional traffic.

The Port Act, emergency legislation designed to help workers and businesses affected by the collapse of the Francis Scott Key Bridge, has been approved by lawmakers. It allows Moore to access funds to provide support for those workers who rely on the port for their livelihoods and businesses impacted by the collapse. It can also be used to provide incentives for companies to use the port again when it is fully reopened. This could provide the impetus needed for the Port of Baltimore to return to its previous levels of operation relatively swiftly.

As the chart below shows, Interact Analysis expects the agriculture vehicle market in North America to contract by around 6% in 2024 and the road building vehicle market to drop by around 4%. Although, it does not predict the collapse of the Baltimore Bridge having a substantial impact on these forecasts and sales of both agriculture and construction machines are anticipated to return to a growth trajectory from 2025 through to the end of the decade.

![Doosan Bobcat Wacker Neuson Stack 2ec Js Pb V6e[1]](https://img.greenindustrypros.com/mindful/acbm/workspaces/default/uploads/2025/12/doosan-bobcat-wacker-neuson-stack2ecjspbv6e1.CPyyz8ubHn.png?ar=16%3A9&auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=135&q=70&w=240)