Imagine you’re in an open field. Your task is to cultivate this field, to harvest it many times over for a period of 10 years. You’re provided with seeds, equipment (tillers, harvesters, trucks, etc.), and a stellar field team, with green thumbs attached. How do you begin?

A knee-jerk reaction might be to lean on your field team’s expertise: Get them started planting, and perhaps set up a commission structure where, after base salary, each is paid proportional to the harvest they yield. They’ll do what they do best and deliver yield reports to you on a regular basis, and you won’t have to do much farming yourself.

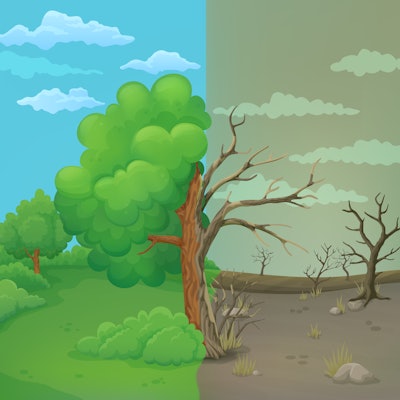

That plan seems good and fine, until, a few years in, you realize the team mainly focused on high-yield crops, and 20% of the field now lays neglected and dry. Those high-yield crops are also quite similar – your team historically specialized in large fruit trees, putting you at risk if you have a fruit-eating pest problem. Moreover, all the other crops in the middle, with moderate yields and in varying states of health, are starting to exhibit a strange behavior. They’re not taking to the soil like they once did. Is this due to a shift in climate? Did the crops themselves mutate in some way, and you need to invest in new fertilizer or watering methods? How could you have noticed this earlier?

Replace crops with customers in this scenario, and you have an outlook of business development challenges facing retailers in 2020. Consumers are increasingly fickle, aided by a digitally transformed economy rich with suppliers and purchasing options that breeds brand agnosticism and heightened competition. A retailer’s customer base should thus be viewed as a delicate and constantly evolving resource, which, much like cash crops, must be systematically cultivated in order to reap sustained, long-term growth.

Below, let’s flesh out why retailers need to devise a customer cultivation strategy in 2020, and how they might go about such a task in terms of data collection and key metrics to track

A Shifting Ecosystem

At the outset, let’s assess the stakes: Just how malleable is the 2020 consumer landscape?

With ecommerce in full swing, consumers now have lots of purchasing options and they use them. About 31% of the nearly 21,000 respondents in the PwC 2019 Global Consumer Insights Survey indicated they buy something online weekly or more frequently (up 5% since the year prior). Moreover, 24% indicated they make non-grocery purchases via mobile/smartphone at least weekly, a figure that has steadily increased over the last three years, along with PCs, at 23%, and tablets, at 16%.

Now, this doesn’t necessarily mean consumers have stopped buying in-store, 49% of respondents made non-grocery purchases in-store at least weekly, but rather that digital and physical channels are coalescing in a unified customer-brand experience. As Salesforce reported in March 2019, 87% of consumers begin their purchasing journeys online, regardless of how those journeys end. The phenomenon even extends into the aisles themselves. As Forbes reported on a 2018 consumer study, 82% of smartphone users consult their phones ahead of imminent in-store purchases. That’s right, John Doe might be standing right in front of you in your showroom, comparing your battery-powered trimmer prices to the big box store down the road.

A hybrid model is also increasingly popular, as customers take advantage of BOPIS (Buy Online, Pick Up In-Store) programs to stave off both savvy salesmen and shipping fees. Forbes reported in a 2019 study of 2,000 American adults, 62% of respondents indicated they “click and collect” regularly. Furthermore, of that 62% who engage in BOPIS, 85% made an additional purchase upon going to the store for pick-up. This certainly represents an opportunity for retailers to leverage the online, offline.

One bad experience at any touchpoint, a prolonged customer service encounter, or a frustrating bug in a digital promotion, and that customer might be gone. According to a 2018 PwC consumer experience report, 59% of U.S. consumers will disengage with a brand after several bad experiences, and 17% will walk away after one bad experience.

So, we now have empowered consumers with innumerable purchase avenues engaging with a multitude of brands across multiple channels. In short: the consumer landscape of 2020 is quite fluid. An active cultivation of a retailer’s existing customers is therefore imperative in order to hang on to them, lest their next purchase slip through your fingers to the BOPIS offer down the street.

Surveying the Field

Before we can develop a Green Thumb to get customers rooted in our brand and product offerings, we first need a pulse: What does our customer base look like at present?

To answer that question, retailers need data in near real time, as customer trends are constantly in flux. This dynamic database will need a primary data source from which to derive unique customer records. For OPE dealers, two main sources stand out:

- POS (Point-of-Sale) System – From whole goods to parts and service, point-of-sale data will give a near wholistic view of who buys what and when. By piping this information on a regular basis to a central database and rolling the records up under unique customer IDs (e.g., combinations of names and address), you suddenly have a base-line, dynamic hub for all your customers and their purchase histories.

- Product Registrations – Warranty registrations also offer a rich source of customer data, but with some caveats. They typically only cover whole goods, not all units get registered, and the data likely lives in separate software systems based on the manufacturer. Nonetheless, the registrations might include extra fields like primary occupation, so it’s worth considering merging them into those POS-derived customer records.

Next, with a baseline archive in place, we can look for secondary sources to enrich the customer database as much as possible. Some items to consider include product information, such as categories and operating similarities (e.g., battery-powered vs. gas); demographic information, such as age and gender, as compiled from public and private data sources or voluntary customer feedback forms; and touchpoint information from each of your sales and marketing channels, from email campaigns to promotions, social media engagements, and CRM notes.

Having all this customer data in a central, cleaned, and easily accessible repository will allow retailers to effectively monitor and grow their customers.

Cultivating Your Customer Base

To return to our field and crop analogy, a retailer can grow its customer base in two ways. Outwards, in an effort to plant new crops and expand the field as far as possible and downwards, in an effort to have deeply rooted crops that provide a sustained, repeatable harvest. By focusing on customer breadth and depth, we thus bring new customers into the fold, and strengthen their brand engagement.

In forming a systematic cultivation strategy, let’s first look at breadth. What key metrics can retailers use to increase customer reach?

- New / Repeat Customers – A business won’t grow if it’s not attracting new customers, period. Track the incidence of purchases with new unique customer IDs, with alerts if the ratio is too lopsided. A very low new customer rate indicates a marketing, merchandizing, and/or branding problem, whereas a very high rate indicates a customer retention problem.

- Market Penetration – As you’re able, try comparing against publicly available consumer data, like the census. Knowing your penetration by county, city, or zip code, as well as demographics, gives a sense of room to grow in a given area. To dive in further, try viewing penetration-by-product to notice product types driving new customer acquisition, or opportunities for cross-selling.

- Customer Mix – Keeping tabs on customer spread by demographic, location, or purchase behavior helps to guard against having too many eggs in too few baskets. Compare the percentage of transactions as well as overall revenue by customer segment, and focus areas will likely jump out.

Using these metrics to make sure you grow outwards is fantastic, but only tells part of the story. The real struggle lies in keeping those customers.

By gauging the following metrics to track customer depth, retailers can identify customer health and areas of focus:

- Purchase History by Product – Customers who buy multiple products and services are certainly more deeply rooted than those who don’t, and those who buy multiple types of products are more engaged still. So, you’ll want to track things like product volume per customer and product categories per customer, both by customer and in aggregate (ZIP or customer segment). Looking at average revenue per product can give further context, as a customer may buy expensive products at low volume, or vice versa.

- Purchase History by Transaction – In addition to looking at what your customers bought, it’s useful to track the purchases themselves: Does Sally stock up once a quarter, or make ongoing small purchases as-needed? Metrics might include transactions per customer, transaction frequency, transaction recency, and average revenue per transaction.

- Touchpoint & Sentiment History – It’s great to know that Joe bought 2 items in one transaction last year, but even better to know that he opens 35% of the emails you send him, has liked your Facebook page, and made that dual purchase through a BOGO sale. Hearing from customers directly from surveys is useful as well. Classic engagement metrics like net promoter score, gauging likelihood to recommend a product or service on a scale of 0-10, and overall satisfaction are great starting points.

These and other metrics can help retailers quickly identify and address customers requiring attention. Maybe inbound marketing is needed for a segment with falling engagement, or individual outreach is needed for a large account that still buys plenty of trimmers, but not many backpack blowers. In subsequent articles, we’ll dive further into possible action plans for building depth and breadth through marketing, sales, and merchandising tactics, though the crux of the matter is quite simple act.

In all, cultivating customers as a dynamic and delicate resource will allow equipment sellers and other retailers to ward off those dry spells, and instead head towards lush, green pastures. Keeping a constant thumb on the breadth and depth of that pasture is crucial, as customers’ needs and attentions can turn on a dime: Indeed, the grass will only get greener if you know its size.