In a world that often moves lightning fast, and a proliferation of data being created more today than yesterday, here are some fun facts to chew on:

- Data volumes have skyrocketed. More data was generated in the last two years than in the entire human history before that.

- Statistics show big data adoption can increase retail sales by 3% to 4%.

- Moving to a cloud can improve a business’s agility (by 29%) and shorten payback times by 30%.

- Companies that harness big data’s full power could increase their operating margins by up to 60%.

- Yet, surprisingly, 99.5% of collected data never gets used or analyzed.

(Sources: Forbes, EMC, Wikibon, Statista, MarketWatch, BCG, Analytics Insight)

With so much data available, and little of it being properly applied, sometimes it is healthy to take a step back and ask oneself, “What insight do I really need, derived from my data, to make smarter and faster decisions for my dealership, employees, suppliers, and most importantly, my customers?

To be clear, raw data unto itself has little to no value. When it is synthesized (combining different data sets), then be analyzed (critical thinking), and finally applied (process) does it then create solutions to solve a problem. So, it is not a surprise with so much data available, not properly applied results in 99.5% of collected data are never getting used or analyzed. Like the adage, “product is what product does” is akin to “data is what data does.” A chain saw cuts wood. But in the hands of a masters, firefighters can save lives in a burning house, or public-safety officials can quickly clear traffic ridding of a fallen tree across the road during a storm, or some can carve masterful ice-sculptures. It takes both the “object” and the proper application to create a special outcome.

To convert data into something worthy, business reporting typically provides three types of learning:

- Validation - Reinforces what I already inherently know.

- Enlightenment - Debunks a myth that I thought was true.

- Realization - Discovers an anomaly I never knew existed.

For dealerships, there is treasure trove of data being collected each an everyday ranging from customer transactions, inventory min-max levels, service tickets, and AP/AR, to name a few obvious examples. Most of this data is collected, stored, and accessed within their dealer management system (DMS). It is transactional in nature and not too complex in structure. It helps make the apparent operational and finance decisions possible such as profit guidance, tax exposure, credit concerns, inventory ordering, floor plans, vendor displacement, and supplier management, to name a few. This is the bread and butter to keep the shop humming along. From such information, you probably already have a hunch at the end of the day or week the expected outcomes.

“I betcha we are having a very profitable day. Let me check. Yep, told ya so.”

Clearly it is always comforting to get information that supports your hypothesis. Validation, just as it was defined above, reinforces confidence.

But what if it went a step further, such as delivering enlightenment and realization? What other types of output related to, and in combination with the obvious DMS data, starts to paint a broader picture? What frequent work streams exist at the dealership where additional insight may help you generate more foot traffic, increase profits, mitigate hidden sunken costs, empower the staff, get more qualified people to your next open house, improve your digital footprint?

You may be surprised to unearth these opportunities by applying some of your current data currently at your fingertips, like raw ingredients to a bake perfect cake. Perhaps it takes a combination of your DMS plus outside third party data and processing to deliver the results you need.

Let's explore the canvas.

Market analysis

Maybe one objective is to understand to expand your geographical reach to open a new location or drive more traffic to your existing.

Key indicators to analyze potential growth would include current product and customer penetration by counties and zip codes comparative to market size, population, and income shifts. Slice that by buyer types such as pro versus homeowners or male vs. female. Add in market penetration by homeowner single unit dwellings. Overlay it with dealer density relative to other competitive brands within a certain drive time distance.

An analysis such as this would determine if you were over saturated in one area, underserved in another, and recognize which route to take to receive the greatest return on investment.

Customer analysis

Customers come in many flavors, as you know. Segmenting them across purchase trends by time, by product categories, recency, frequency, and monetary profitability allows dealerships to see who is really driving the most volume and profit based on the 80:20 rule. You may think just because a particular landscaping company is your top volume buyer does not always translate into your most profitable customer. Not until the empirical facts are revealed will it debunk a myth.

Knowing how many of your customers, by profile type, drive by other local dealerships to buy from you can be very enlightening. Maybe even very satisfying and ideally profitable.

Product analysis

You stock up with lots of different SKUs across lots of different product categories. It could be anything from paint to gas grills, to ZTRs. If you an OPE-centric dealership, the product lines are more akin, though some of the recent trends of adding powersports adds a new twist. Regardless of what you sell, understanding what to see next to the base of customers tends to drive up profitability.

Cross-sell is one simple exercise to conduct upside revenue and inventory flow possibilities.

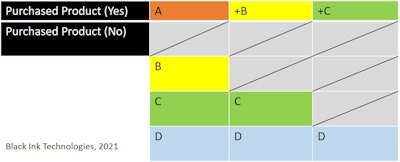

Cross-selling occurs when you sell customers offerings that complement or supplement the purchases they have already made. For example, a customer has bought a chain saw. What next? Will it be a hedge trimmer, sod cutter, chaps, or safety glasses? This exercise is simply to understand the white space as to focus on promoting and selling the adjacent product. For example: “Show me all the customers who bought Product A, but not product B, C, D. Show me all the customers who purchased Product A, B, and C, but not D.”

Software does not define strategy and it cannot replace human experience. But the right ones empower people to make smarter and faster decisions. Having the proper dealership software and analytical tools that are easy to use and can provide meaningful actions, can free people up to focus on what they do best: Merchandizing, servicing, and supporting their clientele. And maybe get them spend less time manually building reports and more time friends and family.

![Gravely Pro Turn Mach One My23 Dsc03139 Edit 1200x800 5b2df79[1]](https://img.greenindustrypros.com/mindful/acbm/workspaces/default/uploads/2025/10/gravely-pro-turn-mach-one-my23-dsc03139-edit-1200x800-5b2df791.BucBnDoN22.jpg?auto=format%2Ccompress&fit=crop&h=100&q=70&w=100)

![Gravely Pro Turn Mach One My23 Dsc03139 Edit 1200x800 5b2df79[1]](https://img.greenindustrypros.com/mindful/acbm/workspaces/default/uploads/2025/10/gravely-pro-turn-mach-one-my23-dsc03139-edit-1200x800-5b2df791.BucBnDoN22.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)