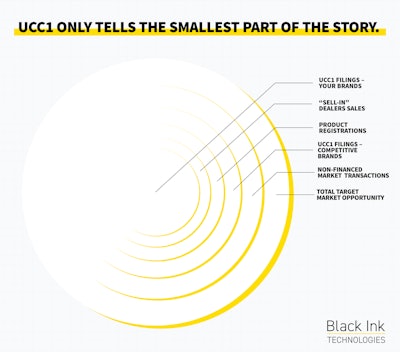

Many manufacturers, wholesale distributors and independent dealer organizations across the power sports, outdoor power equipment (OPE), agriculture and construction verticals use Uniform Commercial Code-1 (UCC1) filings to help gauge product sales success and inform direct marketing efforts. There is nothing wrong with this, but it is incomplete because it doesn’t paint a full and accurate picture of the market, or growth opportunities, leaving many wondering, “Do I rely too much on this data to help make strategic planning, territory management direct selling, forecasting, budgeting and tactical direct marketing decisions?”

Below outlines the gaps that exist to help you better understand how to fill them in to make more precise and accurate decisions. Even if you had this information in a database or a dashboard, using labor time chasing shadows of opportunities can be costly. In the end, you may notice that a far more advanced and integrated data management system is needed to narrow these gaps.

We are going to use commercial lawn-mowing equipment throughout the article to demonstrate the point, though you can plug in your product category—such as tractors, trucks, sprayers, trailers, utility terrain vehicles (UTVs), golf carts—and the principal remains the same.

Gap 1: UCC1 Filings Don’t Define the True Total Size of Market

The total number of landscape maintenance, grounds maintenance, commercial accounts and municipalities usually have a North American Industry Classification System (NAICS) code—formerly Standard Industrial Classification or SIC. Companies use these to help determine just how many types of companies exist. While the codes are attributed to a particular industry category, it should be used as guidance, not necessarily as empirical evidence defining the totality of the marketplace. Why does this matter? There are three important outcomes.

Number one, because the information is provided by the end-user establishment (self-reported), it forces a company to choose the primary NAICS of which the government then uses “a production-oriented concept, meaning that it groups establishments into industries according to similarity in the processes used to produce goods or services.” This means landscapers who conduct various services, ranging from irrigation, chemical applications and lighting to lawn maintenance and hardscape construction, basically choose one NAICS code. If they choose hardscape construction on the Census, they could get lumped into a totally different category than, let’s say, lawn maintenance. This matters to companies that sell commercial mowers that overlook this entity when conducting their total market size.

Secondly, not all small business even fill out the Census, which invariably means that there are more companies than the Census can calculate, usually leaving a margin of error in the sizing of the market.

Thirdly, because it is self-reported, there can be wide discrepancies on filings, such as annual revenue and employee size. This may have something do with the large percentage of landscape maintenance companies being classified as single-owner operated, when they could have a flex crew of six. It is not surprising to see the wide percentage variances between company income and actual assets. As one example, Company A claims an annual gross revenue of $63,000 with one employee, but operates four F350s, two vacs, six zero-turns and 15 handheld power equipment tools.

Gap 2: UCC1 Filings Don’t Define Total Target-Market Transactions

Not all companies like to finance equipment. Many still use cash. There are many reasons why this happens. Maybe it is just a preference not to finance. Maybe the dealer gives an extra incentive for cash transactions. Maybe it’s to reduce end-of-year tax exposure. Whatever the prerogative, this often leaves a very large gap for understanding the total target-market transactions. This gap can vary tremendously depending on the user’s circumstance or the total transaction price. But let’s not just assume any purchases over some dollar amount are always financed. Upon investigating dealer point-of-sale data, many single-day transactions of bundled power equipment products for commercial business of all types register in the $50,000+ range. All in, you bet, cash.

Just using UCC1 filings can often leave you behind 10, 20 or even 50 percent visibility of the total units sold in the market.

Gap 3: UCC1 Filings Are Proof about a Past Transaction, Not Proof about Future Ones

Timing always matters and, like all good financial disclosures, “Past performance may not be indicative of future results …” is the most appropriate phrase for analyzing past purchases to inform future purchases. There are way too many variables in the economic system—unpredictable climate shifts, competitive changes, regulations and the health of the customer—to make predictions about when a company is going to purchase products in the future. This is important because many companies use simple math between the timestamp of UCC1 filing plus the estimated sales transaction cycle of its product to target-market a company. But this approach is rear-view, not real time.

What if, during this time period, the company goes out of business? Or sells its previous product on the used marketplace? Or refinanced? Or paid the loan off early? Or bought more with cash? Or moved? Or held onto the product post-loan? The growth opportunity is forward-looking and it requires an all-in analysis of many different data sets, such as housing statistics, population shifts, consumer confidence, geo-trade areas and competitive shifts.

Propensity modeling (a.k.a. trying to determine the when in next product purchases) requires a far more complicated algorithm.

If you have an exclusive, multi-line or even the fourth brand represented by the dealer, there are better ways to understand how and why what happened in the past happened.

Gap 4: UCC1 Filings Are Better Suited for Product Share, Not Market Penetration

The intrigue to know what your competition sold for units relative to your retail sales helps gauge estimate of product share percentage. It helps understand competitive unit share trends, too, but keep in mind that knowing the total number of market transactions sold in industry is always going to be a larger percentage than the UCC1 filing. Some companies like to take the total number of units sold and then divide that by the target market to define market penetration. This, too, is a flawed approach as many companies (or homeowners, for that matter) buy multiple products.

Are UCC1 filings important? Sure. Does it tell the full story? No. The combination of many different data sets being processed, normalized and analyzed in real time is a far more progressive way to help focus your planning, strategy, sales territories and marketing campaigns.

![Gravely Pro Turn Mach One My23 Dsc03139 Edit 1200x800 5b2df79[1]](https://img.greenindustrypros.com/mindful/acbm/workspaces/default/uploads/2025/10/gravely-pro-turn-mach-one-my23-dsc03139-edit-1200x800-5b2df791.BucBnDoN22.jpg?auto=format%2Ccompress&fit=crop&h=100&q=70&w=100)

![Gravely Pro Turn Mach One My23 Dsc03139 Edit 1200x800 5b2df79[1]](https://img.greenindustrypros.com/mindful/acbm/workspaces/default/uploads/2025/10/gravely-pro-turn-mach-one-my23-dsc03139-edit-1200x800-5b2df791.BucBnDoN22.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)