Editor's Note: This article is intended to help you understand the high-level decisions and considerations you’ll need to make. This is not tax or business financial advice and should not be taken as such. Consult with your tax adviser before making any decisions regarding the sale of your business.

You’re not going to work until you die of natural causes. And even if you did, you’d still need to make some plans for what happens to your business after you pass. To gain an expert’s perspective, I spoke with Khane Goodson, a certified financial planner with Citizen’s Bank.

Transition planning or succession planning?

Though many people use these terms interchangeably, they have different meanings in a business setting. Succession planning is defining what needs to happen internally to ensure a smooth transfer of ownership. Transition planning involves all the legalities of transferring business ownership from one person to another.

While they are different, they usually occur at the same time. If you’re going to pass the business to your children or sell it to a third party, you’ll need to make internal, structural changes to the business (succession planning) while also consulting with your team about the legal and tax implications (transition planning).

Succession planning

“Internally, the owner or founder needs to work themselves out of a job,” says Goodson. When the business isn’t dependent on the owner, it’s more “turnkey” for a prospective buyer. Goodson says, “When the business isn’t dependent on the presence of the owner, it’s an investment. When it is dependent on the owner, the current owner isn’t selling an investment; they’re selling a job to the next owner.”

To “work yourself out of a job,” you need to start by listing all the duties that you currently have in the business. Don’t forget to include the ones that depend on you. For example, you may not deal with the marketing day to day, but the credit card used for Google Ad spending is the company card that’s in your name.

Once you have this list, identify the stuff you can delegate immediately. (Like that credit card; put it on your CEO’s company card instead.) Get as much off your plate as possible.

For things that you’re truly responsible for day to day, identify who you can train internally to take over those responsibilities. If it’s an adult child that you’re passing the business to, have them shadow you and learn what you do. If you’re planning to sell to a third party, see what responsibilities you can delegate to your C-suite and high-level managers. (Note: these people are probably already at capacity. Have them also find things they can delegate to others, so they have the bandwidth to take on your job duties.)

Transition planning

Some owners try to do this on their own. Don’t.

You should be working with a team of experts. Your transition planning team should include your CPA, attorney and insurance broker. You should include a commercial banker (in case a loan needs to happen to facilitate the purchase of the business), and a certified financial planner (CFP).

“The benefit of working with a commercial banker is that they may be able to help with other resources, like a CFP,” says Goodson.

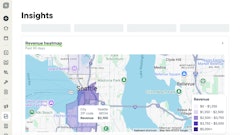

There are many moving parts in these transactions. You should work with a CFP to do some financial modeling and determine the best time to sell your business. Consulting with your CPA and attorney will help you determine how to maximize tax benefits. Some transactions require a life insurance policy to be taken out on both the buyer and the seller to offset the chance of any unfortunate disaster derailing the transaction and leaving everyone in the lurch.

When should I start planning?

“(Start planning) at least five years before you actually want to sell,” says Goodson. If you’ve taken any steps to try and lower your tax bracket, starting at least five years in advance will prevent any “red flags” from triggering an audit.

Consider transferring part ownership to your kids five or six years before you actually want to sell it. For example, if your company is currently worth $10 million and you transfer 20 percent ownership to your child, they’ll “own” $2 million.

If your modeling with your CFP shows that the company is going to double in value over the next five years, you’ll still be in a higher tax bracket (perhaps 35 to 40 percent), but that extra $2 million in company growth (from $2 million to $4 million) happened under your child’s “ownership.” They’ll likely be in a lower tax bracket (perhaps 25 to 30 percent), and you both will have saved the difference in taxes.

Succession planning and transition planning are pretty complicated processes that can take a long time. You should begin the process early, assemble a team of experts to walk you through the process and begin to “work yourself out of a job” as soon as you’ve identified the desire to sell.

![Gravely Pro Turn Mach One My23 Dsc03139 Edit 1200x800 5b2df79[1]](https://img.greenindustrypros.com/mindful/acbm/workspaces/default/uploads/2025/10/gravely-pro-turn-mach-one-my23-dsc03139-edit-1200x800-5b2df791.BucBnDoN22.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)