For equipment manufacturers, especially those who are in or entering the battery world, innovation cycles are rapidly increasing. An OEM/brand may launch battery products with 40V that are lighter weight, longer lasting or more powerful, but then the next guy leapfrogs them with their next launch in a few months. This will lead to markets for machinery becoming highly commoditized and crowded. For equipment distributors, the competition can be just as rough. It is no longer good enough for distributors to pitch refill rates, warehouse size, number of units shipped, or next day delivery as unique differentiators. Worse is just having the local territory manager show up a few times per quarter, ostensibly trying to maintain a “relationship” but only trying to upsell for more product orders. These examples are table stakes.

In order to attract more and build solid relationships with dealers, OPE distributors need advanced ways of setting themselves apart.

Read next: Attract the Baby Boomer Market

One solution is to provide OPE dealers with greater insights on how to help them get, keep, and grow their consumer/professional customer bases. In other words, they can form a strategic alliance. Prove you can add value to the consumer who opens up his/her wallet at the register, and the retailer owner will have greater confidence.

Customer intelligence lets you have greater visibility of the makeup of the customers that have already made prior purchases and the mindset of those that have yet to do so, which can benefit the OEM, the distributor, and the retailer - but acquiring it isn't always easy. Hence the logic behind working together.

Centralized and decentralized models

A customer insight research initiative can be either a centralized or a decentralized model across all three entities.

Under a centralized model the workflow process is less fragmented because data is collected by a single entity and then shared with the others. An example of this is a retailer sharing information back upstream through the supply chain to help inform decision making for any brand and product launches, co-op spend tactics, media channels, etc. Or, an OEM/brand sharing the customer profile with the distributor and dealer to add value to their relationship.

Planning for capturing hearts and minds (and wallets) is critical for balancing short-term and long-range planning, but it is crucial to steer clear of generalizing.

For instance, the changes in purchasing behavior from Baby Boomers to emerging Gen Z can vary significantly from region to region.

Read next: Marketing Landscaping and Lawn Care Services to Millennials

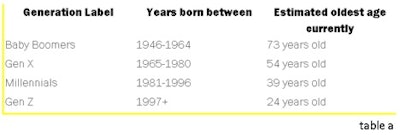

Just to add context, review table ‘A’ to understand the oldest age of each of the generational labels. (Note: some organizations use differing birth years to define the generation, but for the purposes to make the point, no need to split hairs.)

Gen Z/Millennials tend to be more concentrated in urban environments, and therefore require less landscaping. Though this trend may change in the next 10 to 15 years or so – due to children, space limitations or rising real estate prices – the current assumption is that older customers represent your ‘bread and butter.’ Hopefully, most or all your customers who fall under the Baby Boomer generation have purchased from you more than once.

Table ‘B’ suggests different strategies to use when targeting segments based on customer age. Again, it is important not to generalize – a few Millennials might show Loyalist behavior for instance – but for the most part it is good to follow these guidelines; they will help you ‘divide and conquer’ the market.

According to Alliance Analytics Data & Insights Institute, a large difference between each generation is made up by their expectations when it comes to their desires to engage with brands and their respective retailers/dealers online.

Some of the research comes as no surprise, but there are a few exceptions. For example, there’s a rise of Baby Boomers who are engaging digitally with platforms such as Facebook, so let’s not universally label them as ‘old fogies’ any longer.

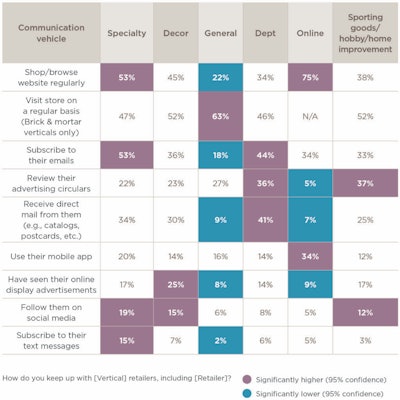

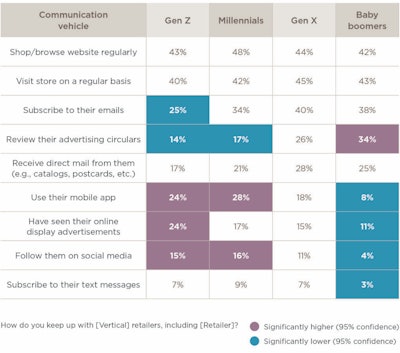

You may ask, does shopping venue affect behavior, and if so does the affected behavior differ between different age groups? The answers are yes and yes. These comparison charts from the report illustrate shopping trends broken down by shopping venues and age groups.

Their next chart breaks down behavior by age groups.

It is demonstrable that consumers who are more digitally-inclined (i.e. Millennials) generally want to seek out experiences that have control-granting mechanisms such as mobile apps, web-based selling platforms, and social media.

Those from older generations, for the most part, prefer the exact opposite in terms of engagement with companies, opting instead for traditional channels such as ad circulars, visiting stores, and personalized e-mails. Perhaps it is more convenient to stay with what they are familiar with rather than adapting to new ways of doing things.

Read next: How to Help Millennials Sell to Baby Boomers

OPE dealers who still don’t have the basics down for managing a website or producing relevant content are at a disadvantage and could get lost among the pure play e-commerce companies or Big Box retailers who can invest millions to reach millions.

If dealers don’t adjust soon, then perhaps the need for centralization to drive traffic falls more on the OPE brands who can outsource to specialized providers to analyze consumer segmentation, buying patterns, digital footprints, improved web experiences, social media, and more.

The challenge, however, is that some OEMs think they can build analytics platforms in-house versus outsourcing. A

fundamental shift can and should occur if they want to continue to support independent OPE retailers to move inventory. Either way, fill in the gaps, but don’t produce stop gaps. Investment in customer intelligence at the retail level lifts all boats in the harbor.

![Gravely Pro Turn Mach One My23 Dsc03139 Edit 1200x800 5b2df79[1]](https://img.greenindustrypros.com/mindful/acbm/workspaces/default/uploads/2025/10/gravely-pro-turn-mach-one-my23-dsc03139-edit-1200x800-5b2df791.BucBnDoN22.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)