I had the privilege of moderating a tele-conference with financials expert Frank Ross on February 12. The call was part of a “Stump Frank” question-and-answer session with contractors from all over the country, many of whom are engaged in Frank’s A Better Way 2 Learn Financials training program.

Several good questions were asked, to which Frank offered seemingly endless layers of insight and analysis.

One concept that really stood out to me was during a discussion of how to recover equipment costs in your estimating and financial systems. Some of the more hard-core contractors actually establish hourly rates for each major piece of equipment their crews operate. This is a great way to go, but can be rather complex and time-consuming. But it is the most precise way to ensure that you are charging what you should, per hour, for use of your equipment.

However, you have to really be spot on with your hourly equipment rates. If you’re off, you could fail to recover all of the necessary costs for your equipment—ultimately hurting your bottom line, not to mention your ability to manage and update your equipment fleet down the road.

What factors into the “total cost” of a piece of equipment?

- Ownership (what you paid for it)

- Replacement value

- Major repairs

- Preventive maintenance

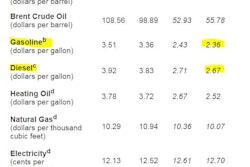

- Fuel

- Insurance

- Shop overhead

You’ll want to roll all of these up in order to identify the lifetime cost of a piece of equipment. Then you figure out how many hours you’ll be able to get out of this piece of equipment over the duration of its life. Do some simple division and, voila, you have your hourly rate.

As you can see, this can become complex and time-consuming. That’s why Frank Ross offers the following piece of advice: Unless your total equipment costs exceed 20% of your sales, it probably makes more sense to recover equipment costs simply as part of overhead. The payback of tracking equipment utilization at the job level will not be that great. In fact, trying to do so could actually become more of a cost to your company than anything else.

You can check out the official A Better Way 2 Learn Financials blog here: http://www.abetterway2learn.com/blog/