No one goes into the Green Industry to get rich. We work in this space because we love it.

You still have to eat, rent or a mortgage to pay, and payroll to meet. How do you make sure you’re pricing your services correctly so that you don’t find yourself at the end of the year having made eight bucks an hour?

How to Account for Costs

Expenses break down into two general categories for most green industry companies: direct costs (related to a specific job) and overhead costs (those needed to run the business but not associated with a particular job).

Examples of direct costs are plant material, soil, pavers — anything that you can say, “We used ‘X’ amount of this on the Johnson job.” You may be able to break them down by square footage (with fertilizers, mulch, or pavers, for example).

Overhead costs are things you need but can’t assign a value to, like your mortgage, internet, and non-billable labor (manager’s salaries, etc.).

Some things don’t quite fit either bucket. You use gasoline for direct costs (to get to and from a job site, etc.), but it’s nearly impossible to calculate. How much gas are you consuming per mile on each truck or per hour on your mowers? It’s easiest to lump it in with your overhead costs to simplify things. You can put it in overhead if you want, but it has to go somewhere.

The point is this: everything that you spend for the business must be accounted for. Overhead costs are the most overlooked for most landscapers. Many of us are great at accounting for our direct costs because those are pretty fixed. But we’re not accounting for the indirect (overhead) costs when running our businesses.

Accounting for Overhead

One way to do this is simple division. You take all overhead costs for the past year and divide them by the total number of direct labor hours (hours spent on a job site), and that will give you an Hourly Overhead Rate to charge.

Total overhead $$ / number of hours on job sites = Hourly Overhead Rate

For example, if my total overhead for the previous 12 months was $300,000 and I had 10,000 hours of direct labor (on a job site), I would do the following equation:

$300,000 / 10,000 = $30

I add that $30 to each hour I’m quoting for labor, and I’ll cover my expenses.

Pricing Pitfalls

There are common pitfalls when it comes to pricing. These oversights impact your profitability.

The first is failing to account for training. Training is field labor time, as well. You should account for your crew leader or supervisor’s time as a billable expense. You’re not going to withhold their pay, and they’re doing work on a client’s property alongside the new hire. Accordingly, they should be billed as field labor.

The second pitfall is similar; owners and managers. If you’re an owner or manager and still work in the field, you must account for your time. Again, bill as hourly labor. If you don’t, you may find you’re working 60+ hours a week, thinking you’re profitable. The truth is you’re only profitable because you’re not paying yourself.

Lastly, build a small “contingency” buffer into your pricing. This can be small (maybe 5%) but will help cover unexpected expenses. If your job runs over on hours or material, you’ve got a small cushion from all other jobs that helps keep your profitability on track.

Calculating Prices

Once you’ve accounted for your Hourly Overhead Rate, you have two things left to do. First, calculate your revenue per employee, per hour. How much money does a single employee generate?

You want to break this up by service line. A mower doesn’t generate the same revenue per hour as a hardscaping crew. So, the best practice here is to split things up by department. This way, you avoid overpricing your maintenance work or underpricing your design/build work.

Lastly, you need to figure out what your profit targets are. If you’re a younger, smaller business, aim for 20% net profit. If you’re more established with lots of employees, you’re probably good at around 12% net profit.

The Actual Math

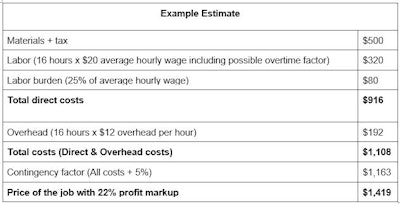

For example, if I know:

- Materials for an edging and mulching job are $500,

- Hourly Overhead Rate is $12,

- The job will take 16 hours (full day for a two-person crew),

- Labor burden (the costs associated with an employee including payroll taxes, health insurance, and other benefits, typically around 25% of average wages). Use your own numbers here!

- I’m paying my field labor $20/hour per person,

- I’m building in a 5% contingency fund, and

- I want to achieve 22% net profit, my equation would look like this:

If the hours were correctly estimated, and you got your Hourly Overhead Rate correct, you should make a 22% profit on this job. You should be able to use that Labor Rate and maintain profitability year-round.

Re-evaluate your hourly rate each year based on your overhead expenses and your desired percent of profitability.